Some choice comments on gold from the former Federal Reserve Chairman previously made on Fox Business News:

Contrary to what the occasionally conspiratorial and always hyperbolic 'Tyler Durden(s)' of ZeroHedge would have you believe, these quotes (while perhaps deserving of a muted 'wow' from those hearing them for the first time) aren't nearly as big of a surprise as World Bank President Bob Zoellick's recent call for a return to the Gold Standard.

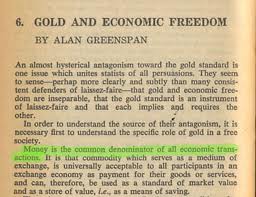

Throughout his career Greenspan hasn't exactly been shy about making his feelings about Au known. Further, Greenspan is a highly paid private consultant right now without any official government responsibilities or gag orders. He (and his clients) are no doubt aware that his words still carry significant weight in the marketplace, and he can say whatever he likes and even talk his own book.

Having said that, as a close student of Greenspan's philosophy and personality I can say with a high degree of certainty that he very much cares about his place in history, particularly at this stage in his career.

In other words, the likelihood that the former Chairman is going on television and talking up gold the past few years just to earn a few bucks from hedge funds is low, in my opinion. And with outgoing Fed Governor Thomas Hoenig also recently weighing in on the yellow metal's merits one can't help notice the growing chorus for a reconsideration of the gold standard.

Continue reading the full article published on SeekingAlpha here.

"We have at this particular stage a fiat money which is essentially money printed by a government and it's usually a central bank which is authorized to do so. Some mechanism has got to be in place that restricts the amount of money which is produced, either a gold standard or a currency board, because unless you do that all of history suggest that inflation will take hold with very deleterious effects on economic activity. There are numbers of us, myself included, who strongly believe that we did very well in the 1870 to 1914 period with an international gold standard."During the interview Greenspan also wondered aloud whether we really need a central bank.

Contrary to what the occasionally conspiratorial and always hyperbolic 'Tyler Durden(s)' of ZeroHedge would have you believe, these quotes (while perhaps deserving of a muted 'wow' from those hearing them for the first time) aren't nearly as big of a surprise as World Bank President Bob Zoellick's recent call for a return to the Gold Standard.

Throughout his career Greenspan hasn't exactly been shy about making his feelings about Au known. Further, Greenspan is a highly paid private consultant right now without any official government responsibilities or gag orders. He (and his clients) are no doubt aware that his words still carry significant weight in the marketplace, and he can say whatever he likes and even talk his own book.

Having said that, as a close student of Greenspan's philosophy and personality I can say with a high degree of certainty that he very much cares about his place in history, particularly at this stage in his career.

In other words, the likelihood that the former Chairman is going on television and talking up gold the past few years just to earn a few bucks from hedge funds is low, in my opinion. And with outgoing Fed Governor Thomas Hoenig also recently weighing in on the yellow metal's merits one can't help notice the growing chorus for a reconsideration of the gold standard.

Continue reading the full article published on SeekingAlpha here.

I would not hire Greenspan to scrub my toilet.

ReplyDeleteAgreed. He's getting a bit up there in age and would likely have a difficult time getting at some of those hard-to-clean spots. However, I would happily use the paper Greenspan's pet theory, the 'Efficient Market Hypothesis', was written on to wipe my ass.

ReplyDelete