This is another excellent panel from the Milken Institute Conference. It has a somewhat more investment focus than the previous one posted with discussion/predictions on the Eurozone (Greece in or out), elections, interes rates, etc.

Showing posts with label Renminbi (Yuan). Show all posts

Showing posts with label Renminbi (Yuan). Show all posts

Wednesday, May 2

Tuesday, January 3

Prediction #1: U.S. Dollar Bears Will Remain On the Run in 2012

Since its March 2008 low the U.S. Dollar is up 13% against a basket of the world's most widely held currencies, including the yen, sterling, franc, loonie, krona, and of course the beleaguered euro.

How is this a problem for portfolio manager Axel Merk, the self described "Authority on Currencies"? After all, according to Merk's written after-the-fact letters he claims to have traded out of and back into the euro just in time to surf its wild gyrations.

Merk moved his fund management business to California a number of years ago, where he has been beating a steady 'demise of the U.S. dollar' drumbeat ever since. This past year Merk Funds even took to deploying amusing anti-Dollar cartoon propaganda while routinely touting the superiority of the euro over the U.S. dollar.

Continue reading the full article at Seeking Alpha here.

How is this a problem for portfolio manager Axel Merk, the self described "Authority on Currencies"? After all, according to Merk's written after-the-fact letters he claims to have traded out of and back into the euro just in time to surf its wild gyrations.

Merk moved his fund management business to California a number of years ago, where he has been beating a steady 'demise of the U.S. dollar' drumbeat ever since. This past year Merk Funds even took to deploying amusing anti-Dollar cartoon propaganda while routinely touting the superiority of the euro over the U.S. dollar.

Continue reading the full article at Seeking Alpha here.

Sunday, October 16

Wednesday, September 21

Thursday, August 11

Barry Eichengreen on What Could Replace the U.S. Dollar

Professor Eichengreen explains the current state of the world's reserve currencies and makes the argument for GDP-indexed bonds here.

Monday, May 30

Monday, April 18

Video: Barry Eichengreen at Bretton Woods on the Past and Future International Monetary Order

And the accompanying Q&A for Barry's panel, which included Keynes biographer Lord Robert Skidelsky.

Monday, January 24

U.S.-China Currency War: Should America Fight Back by Defaulting?

|

| A little less handshaking, a little more action? |

'Bleeding-hearts' types will no doubt want to focus on human rights issues, such as China's not so secret effort to wipeout Tibetan civilization and the ongoing imprisonment of China's recent Nobel Peace Prize winner, Liu Xiaobo.

As the NY Times opinion page put it, "how can one Nobel Peace Prize laureate be silent when meeting the man who imprisons the next?"

And those concerned with the military balance of power can point to concerns about Chinese espionage, secret development of sophisticated weaponry like a Chinese stealth fighter, and China's navy contesting free navigation in the South Sea.

The Renminbi Runaround

There is also the matter of U.S.-China economic relations. As far as the U.S. is concerned, the big one is the exchange rate of China's currency, the renminbi (yuan). It is widely agreed that China's currency is undervalued by as much as 20-40%, providing China with an unfair trade advantage. Much has been written about this issue previously here.

Former Secretary of State and and National Security Advisor, Henry Kissinger, appeared on Charlie Rose this week to discuss relations with China. Not surprisingly, Kissinger argued for a diplomatic solution to the renminbi. While acknowledging that he is not economist, Kissinger believes there should be some way to bring the Chinese around on revaluing the renminbi by offering something in return. My question is hasn't the U.S. already tried that ad nauseam?

Throughout modern history the world's trade and currency order has always followed a set of explicit and implicit 'rules of the game', so to speak. Over the last two decades China has benefitted significantly from first having access to the world's markets and later gaining entrance into the World Trade Organization. While WTO rules do not cover exchange rate manipulation, one of the hallmarks of our current semi-free trade system is floating exchange rates. China exercises heavy control over its exchange rates in a manner completely unlike other major trading powers, such as the U.S.

The key question, put simply, can be expressed as follows: why is there one set of currency rules for China, and another set for everyone else?

Continue reading the full article published on SeekingAlpha here.

Saturday, January 22

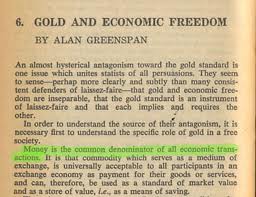

Greenspan's Opinion on the Gold Standard and Where's Gold Heading Now?

Some choice comments on gold from the former Federal Reserve Chairman previously made on Fox Business News:

Contrary to what the occasionally conspiratorial and always hyperbolic 'Tyler Durden(s)' of ZeroHedge would have you believe, these quotes (while perhaps deserving of a muted 'wow' from those hearing them for the first time) aren't nearly as big of a surprise as World Bank President Bob Zoellick's recent call for a return to the Gold Standard.

Throughout his career Greenspan hasn't exactly been shy about making his feelings about Au known. Further, Greenspan is a highly paid private consultant right now without any official government responsibilities or gag orders. He (and his clients) are no doubt aware that his words still carry significant weight in the marketplace, and he can say whatever he likes and even talk his own book.

Having said that, as a close student of Greenspan's philosophy and personality I can say with a high degree of certainty that he very much cares about his place in history, particularly at this stage in his career.

In other words, the likelihood that the former Chairman is going on television and talking up gold the past few years just to earn a few bucks from hedge funds is low, in my opinion. And with outgoing Fed Governor Thomas Hoenig also recently weighing in on the yellow metal's merits one can't help notice the growing chorus for a reconsideration of the gold standard.

Continue reading the full article published on SeekingAlpha here.

"We have at this particular stage a fiat money which is essentially money printed by a government and it's usually a central bank which is authorized to do so. Some mechanism has got to be in place that restricts the amount of money which is produced, either a gold standard or a currency board, because unless you do that all of history suggest that inflation will take hold with very deleterious effects on economic activity. There are numbers of us, myself included, who strongly believe that we did very well in the 1870 to 1914 period with an international gold standard."During the interview Greenspan also wondered aloud whether we really need a central bank.

Contrary to what the occasionally conspiratorial and always hyperbolic 'Tyler Durden(s)' of ZeroHedge would have you believe, these quotes (while perhaps deserving of a muted 'wow' from those hearing them for the first time) aren't nearly as big of a surprise as World Bank President Bob Zoellick's recent call for a return to the Gold Standard.

Throughout his career Greenspan hasn't exactly been shy about making his feelings about Au known. Further, Greenspan is a highly paid private consultant right now without any official government responsibilities or gag orders. He (and his clients) are no doubt aware that his words still carry significant weight in the marketplace, and he can say whatever he likes and even talk his own book.

Having said that, as a close student of Greenspan's philosophy and personality I can say with a high degree of certainty that he very much cares about his place in history, particularly at this stage in his career.

In other words, the likelihood that the former Chairman is going on television and talking up gold the past few years just to earn a few bucks from hedge funds is low, in my opinion. And with outgoing Fed Governor Thomas Hoenig also recently weighing in on the yellow metal's merits one can't help notice the growing chorus for a reconsideration of the gold standard.

Continue reading the full article published on SeekingAlpha here.

Friday, January 21

Thursday, January 13

Ken Rogoff Forecasts "Currency Chaos" in 2011

Continuing the 'chaos' theme, thoughts on how various currencies will fare in 2011 can be found here from Ferguson's Harvard colleague Professor Ken Rogoff, author of This Time is Different.

Note to U.S. dollar bears: Rogoff points out that the U.S. dollar's "purchasing power is already scraping along at a fairly low level globally – indeed, near an all-time low, according to the Fed’s broad dollar exchange-rate index. Thus, normal re-equilibration to “purchasing power parity” should give the dollar slight upward momentum."

Note to U.S. dollar bears: Rogoff points out that the U.S. dollar's "purchasing power is already scraping along at a fairly low level globally – indeed, near an all-time low, according to the Fed’s broad dollar exchange-rate index. Thus, normal re-equilibration to “purchasing power parity” should give the dollar slight upward momentum."

Thursday, January 6

Timing the Inevitable Decline of the U.S. Dollar

One of the most heavily debated macro topics is the future of the world's reserve currency, the seemingly almighty U.S. Dollar.

Neither the fact that scores of prognosticators have been predicting its demise for decades, nor that when the financial going gets tough (as it did during the 2008-2009 financial crisis) everyone wants it, has dissuaded today's dollar bears from taking a dim view of the greenback's future.

America's Exorbitant Privilege

Neither the fact that scores of prognosticators have been predicting its demise for decades, nor that when the financial going gets tough (as it did during the 2008-2009 financial crisis) everyone wants it, has dissuaded today's dollar bears from taking a dim view of the greenback's future.

America's Exorbitant Privilege

|

| Barry Eichengreen |

Professor Eichengreen opens with the point that while we now live in a multi-polar economic world the financial system and monetary order still revolve around a single currency (the U.S. Dollar).

Some might be surprised to learn that approximately 75% of all $100 bills circulate outside the United States. The reserve currency holdings of the world's central banks are largely in U.S. Dollars or U.S. Dollar denominated assets (e.g., U.S. Treasuries).

What precisely is the 'Exorbitant Privilege' conferred on the United States by the special role its currency plays in the global financial system?

Professor Eichengreen calculates that the U.S. dollar’s status as the world's reserve currency is worth 3% in U.S. national income per year. In other words, having the world’s dominant reserve currency allows the U.S. to run an annual $500 billion current account deficit.

Some may remember Vice President Cheney's quip that "deficits don't matter", or Nixon Treasury Secretary Connally's response to foreign governments, critical of the U.S.’s profligate Vietnam and Great Society spending, on how the U.S. Dollar was "our currency, your problem". It is this 'Exorbitant Privilege', a term coined by French leaders in the 1960s who railed against the fact that American paper currency could be exchanged for "real stuff", which Professor Eichengreen views as unsustainable.

Are Reserve Currencies Analogous to Computer Operating Systems?

Economists explain the U.S. Dollar's rise and dominance through a principle called 'network externalities' (or 'network effect'). Similar to how significant interoperability advantages in computing can be achieved through the adoption of a single operating system (e.g., Microsoft Windows), the widespread use of a single currency (the U.S. Dollar, and previously British pound sterling) can lead to mutually beneficial economic efficiencies.

However, in a world where 'Currency Converter' is one of the Top 10 most downloaded smartphone apps, determining exchange rates and making currency conversions can now be performed quickly and simply by a vast number of people. Just as the computing world is moving towards multiple operating systems (i.e., Windows, Mac, Linux, Google, iOS, etc.), Eichengreen believes the world will transition to three principal reserve currencies: the U.S. Dollar, the Euro, and the Chinese Renminbi (Yuan).

The Euro and the Renminbi: Assessing the U.S. Dollar Bridesmaids

On the currency topic du jour, Eichengreen believes that "euro gloom and doom is overdone". Just as a default by Los Angeles County won't spell the end of the U.S. Dollar, a default by Greece and/or Ireland won't bring about an end to the euro.

Germany is the one country, in Eichengreen's view, which could afford to abandon the euro without suffering catastrophic economic consequences. However, Eichengreen sees this as unlikely. Germany's next generation of leaders, while not having been around for the birth of the EU, are nevertheless heavily wedded to the European Project. Further, Germany benefits from a weaker euro via more competitive exports. If Germany were to leave the euro then the reintroduced Deutsche Mark would shoot up in value and risk choking off the German export led economic renaissance currently underway.

When it comes to the Chinese renminbi becoming a reserve currency, Eichengreen acknowledges that China needs to make significant changes. For starters, the renminbi will need to become freely convertible. China will also need to develop deep, liquid capital markets and make fundamental changes to its overall development model.

However, these and other changes may come quicker than many expect. A short time ago there were basically zero Chinese companies settling international transactions in renminbi; now 70,000 do so. Two U.S. multinational companies, McDonald's and Caterpillar, have issued renminbi-based bonds. Currently most of these changes are occurring in "China's financial petri dish" (Hong Kong), but China has set a target of making Shanghai a preeminent world financial center by 2020.

Timing the Decline of the U.S. Dollar?

Eichengreen assigns a very low probability to a sudden collapse of the U.S. Dollar. But could it happen? In short, the answer is yes.

A spat over Taiwan or rising tensions in the Asia Pacific over China building its first world class navy in 600 years could cause China to suddenly stop funding U.S. deficits. A more confident and assertive China is likely to continue to flex its newfound muscles, a subject I previously covered in more detail here.

However, what Harvard’s Larry Summers termed "The Financial Balance of Terror" is likely to prevent a catastrophic scenario from unfolding. Similar to how President Eisenhower threatened to dump the U.S.'s vast British bond holdings during the 1956 Suez crisis if British forces didn't leave the peninsula immediately (which they did), Eichengreen believes that China and U.S. officials will attempt to work out their differences through diplomatic back channels as opposed to openly fighting it out in financial markets.

A more likely scenario would be a sudden loss in investor confidence, like the one experienced by Greece last spring, in the U.S.'s ability to get a handle on government spending. Eichengreen notes how the ratio of U.S. federal debt (a relatively high 75% of GDP) vis-à-vis tax revenues (a relatively low 19% of GDP) is rapidly approaching the danger zone.

From an investment perspective, investors should continue to expect currency volatility under the current U.S. dollar dominated international monetary system. Further, the U.S. Dollar will continue to be the world's safe haven currency in times of crisis for the foreseeable future. However, according to Eichengreen a change in the international monetary order is all but inevitable within a decade.

Thursday, November 11

Sunday, November 7

World Bank President Zoellick Gift Wraps Gold $1400+

'Tis soon to be the season of giving, and the monetary gifts to gold owners are getting off to an early start.

Zoellick's proposal is for a basket of the world's leading currencies - the dollar, euro, yen, pound, and renminbi - to be paired with gold (which he describes as "an international reference point of market expectations") in a new Bretton Woods styled monetary order.

Gold really didn't need much of a reason to finally poke its head above $1400/oz, but Zoellick's op-ed and the gold chatter that's sure to follow will almost certainly provide the nudge.

Meantime gold owners can sit back, grab a bag of popcorn, and enjoy what's about to happen to the price of your Au.

Wednesday, September 15

Bank of Japan Intervention: What Happened Last Time? What's Next?

On Tuesday the yen traded at ¥82.88 yen per dollar, its highest level since May 1995. As predicted the Japanese government decided it had seen enough and instructed the Bank of Japan (BOJ) to 'intervene in the currency market' (aka print money). This caused the yen to quickly fall back to ¥85 per U.S. dollar level.

The BOJ also confirmed that its intervention -- reported to be in the ¥300-¥500 billion range ($3.61-$6.02 billion) -- will go unsterilized, which means that the BOJ will not seek to withdraw the new yen it has 'printed'.

Currency Traders Now Have an ¥82 Yen Bullseye

Via Bloomberg, Japan’s Chief Cabinet Secretary Yoshito Sengoku communicated two very important pieces of information:

Two comments:

The BOJ also confirmed that its intervention -- reported to be in the ¥300-¥500 billion range ($3.61-$6.02 billion) -- will go unsterilized, which means that the BOJ will not seek to withdraw the new yen it has 'printed'.

Currency Traders Now Have an ¥82 Yen Bullseye

Via Bloomberg, Japan’s Chief Cabinet Secretary Yoshito Sengoku communicated two very important pieces of information:

- ¥82 yen per dollar is "the line of defense to prevent currency strength from harming the economy"

- "The government is seeking to gain the understanding of the U.S. and Europe for the intervention"

We now know the Japanese government's pain point (¥82 yen per dollar). Providing the market with an exact target -- not unprecedented for Japan (see below) -- could prove to be a mistake.

We can also infer from the "seeking to gain the understanding" comment that the BOJ's intervention was not only uncoordinated, but also without the consent of other central banks. It would be surprising if the Fed and ECB signed off on the BOJ's intervention. Europe, the U.S. and other nations are mired in a slow recovery and seeking export led growth. Japan's currency intervention makes U.S. and European goods more expensive in Japan.

What Happened Last Time the BOJ Intervened?

It was six years ago when the Bank of Japan last intervened in the currency market. In 15 months through March 2004, the BOJ sold ¥35 trillion yen ($421.7 billion) for dollars. What was the BOJ trying to accomplish? As noted back then Economy Trade and Industry Minister Takeo Hiranuma said "a dollar at ¥115.00 is the ultimate life-and-death line for Japanese exporters".

Two comments:

Sunday, July 4

Is a U.S.- China Economic War On Its Way?

The tone of U.S.-China relations, as evidenced by General Electric CEO Jeff Immelt's provocative “colonization” remarks, are deteriorating rapidly and signaling trouble ahead. Given the importance of this relationship it is important to understand what's at stake and how events may play out.

Sizing Up the Sino-American Relationship

The U.S. has the world's largest economy and the U.S. Dollar is the world’s reserve currency. China has the world’s fastest growing large economy, and it has proven comparatively resilient in the wake of the ‘Great Recession’. China recently passed Japan to become the world's second largest economy, and Goldman Sachs has forecasted that China will overtake the U.S. by 2027.

While the export of manufactured goods to countries such as the United States has been a key driver of China’s growth story, benefits have accrued on both sides of the Pacific. Large U.S. government deficits have been underwritten in part by the thrifty Chinese, and U.S. consumers have snatched up voluminous quantities of low cost Chinese imports.

This seemingly symbiotic relationship, which Harvard Professor Niall Ferguson has termed ‘Chimerica’, avoided close scrutiny during the credit boom years. But amid high U.S. unemployment and a mounting public debt Chimerica is now under a microscope.

China’s “Unfair” Currency Policy

China has been accused of manipulating its currency by pegging the renminbi to the U.S. dollar at an artificially low rate, thereby allowing China to gain an unfair trade advantage. Critics point to China’s more than $2 trillion in largely U.S. dollar denominated foreign exchange (forex) reserves as prima facie evidence that the renminbi is grossly undervalued. Market participants have speculated that if the renminbi were allowed to freely float it would appreciate by 20-40% against the U.S. dollar.

Emerging market and EU officials have joined the U.S. in criticizing China's currency policy. Under pressure, China’s recent announcement that the renminbi would be allowed to float was initially greeted with widespread enthusiasm. However, since the announcement the value of the renminbi has moved within a narrow 0.5% range, remaining effectively unchanged. This has led some critics, such as NY Times columnist Paul Krugman, to accuse China of “playing games”.

A U.S.-China Economic War?

One of history’s unfortunate reoccurring themes is the tendency on the part of political leaders to create foreign scapegoats, particularly when faced with challenging economic times and an uncertain electoral environment. From this perspective surging, recalcitrant China makes for a nearly ideal political target.

Candidates for office can blame the U.S. unemployment problem on “unfair” China competition and the undervalued renminbi. China's large U.S. treasury holdings (estimated at up to $1 trillion, or roughly 20% of all foreign holdings) will also make a convenient target for fear mongers pointing at foreigners as the source of the U.S.’s troubles. Expect increasing criticism of China (reminiscent of 1980s Japan bashing) from politicians, labor groups, talk radio, etc. through this November's mid-term elections and through the next presidential election cycle.

What is the likelihood that the U.S. will go beyond rhetoric and take action? Seeing the renminbi revalued upwards is one of the few policy areas with bipartisan support. President Obama may feel pressure to appear strong and stand up to foreign powers to preserve the American economic way of life. Calls to “do something” will only grow louder in the face of the projected slow employment recovery. In short, formal trade action against China cannot be ruled out.

How would China respond to overt moves by the U.S.? The Chinese government detests foreign pressure. At the same time China's leadership, emboldened for example by the failure of The West to prevent the financial crisis and Google's recent blink, is growing more confident. Looking to flex its new economic and geopolitical muscles, China would almost certainly retaliate in some fashion against any U.S. trade action.

Looking Ahead

Both the U.S. and China possess numerous incentives to avoid a serious breakdown in relations. The economic and political consequences would be devastating for both countries and the rest of the world. The central question is will the U.S. and China be able – or willing – to find a path towards compromise which is also congruent with their respective interests?

It is human nature to underestimate the probability of seemingly unlikely, large-scale events like a U.S.-China trade and currency war. However, students of history know this to be an all-too-frequent mistake.

In considering whether such a conflict can be successfully avoided it is important to remember that policymakers often fail to properly diagnose and head-off the really big problems, such as war and financial crisis. Assurances by officials shortly before the near collapse of the financial system that the subprime problem was "contained" is but one recent example.

What could lead to a more serious escalation of tensions? A WTO ruling, U.S. Congressional action, China’s sale (or further purchases) of U.S. Treasuries, or an Asia Pacific geopolitical event (i.e., Taiwan, North Korea, etc.) are just a few of the possible triggers.

With China in the U.S.'s political crosshairs investors would do well to continue to closely monitor the world’s most important bilateral economic and political relationship. And given the stakes, let us hope that the current U.S.-China trade and currency war doesn't escalate further, for even a mild economic war could be devastating.

Subscribe to:

Posts (Atom)